Often referred to as Digital Natives, millennials were born roughly between 1980 and 2000. They’ve grown up with rapid technological developments and are 2.5x more likely to be an early adopted of new tech trends than other generations. So, when it comes to financial marketing for millennials, having a strong online presence is a must. As a millennial myself (just) and director of leading financial marketing agency Contentworks, here’s my take on financial marketing for millennials.

#1 Embrace Mobile Marketing

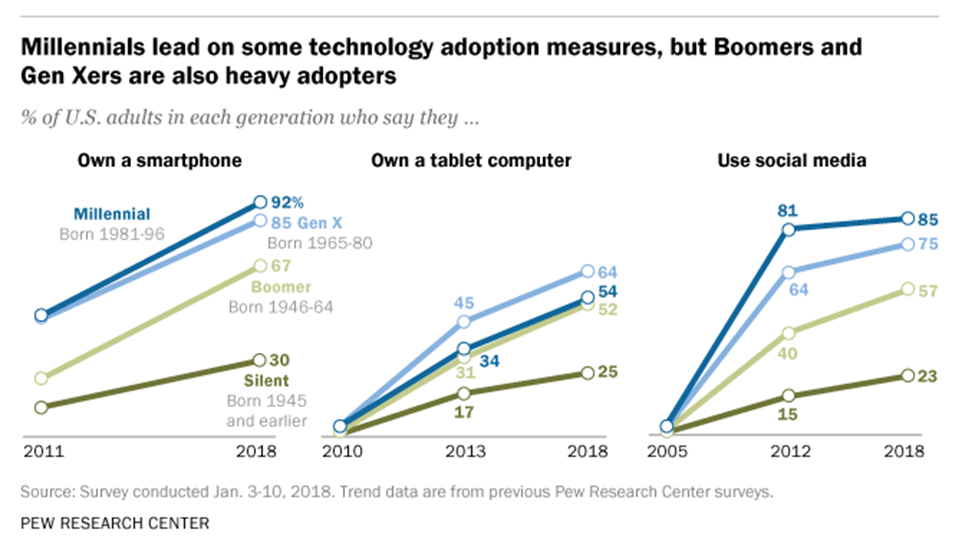

As you can see from the chart below, 92% of millennials use a smartphone. That’s a huge percentage of the millennial population. What’s more, 47% of millennials use mobile banking. So why not use these stats to your advantage? Around 2 billion people across the globe will be using fintech apps by 2020 making it important to embrace trends as soon as possible.

What can you do?

- Mobile-optimise your site

Firstly, it’s really important to optimise your website for mobile use. If you were to notice any of the best SaaS websites online, you’d notice one common thing in them, which is a responsive web design. You need to do the same for your site so if millennials hit you up on the go, they’re not met with a bunch of frustrating web pages that aren’t tailored to a mobile platform. Failing to act will increase bounce rates and do nothing for your online credibility.

- Be user friendly

If you’ve created a branded app, that’s a great start. But as 35% of millennials are willing to jump ship if the whole mobile banking process takes too long, try to make things as simple as possible. You’re dealing with a generation that’s notoriously impatient and rightly so. The reality is, there are so many competitors out there waiting to steal your business, that you really need to step up to the plate.

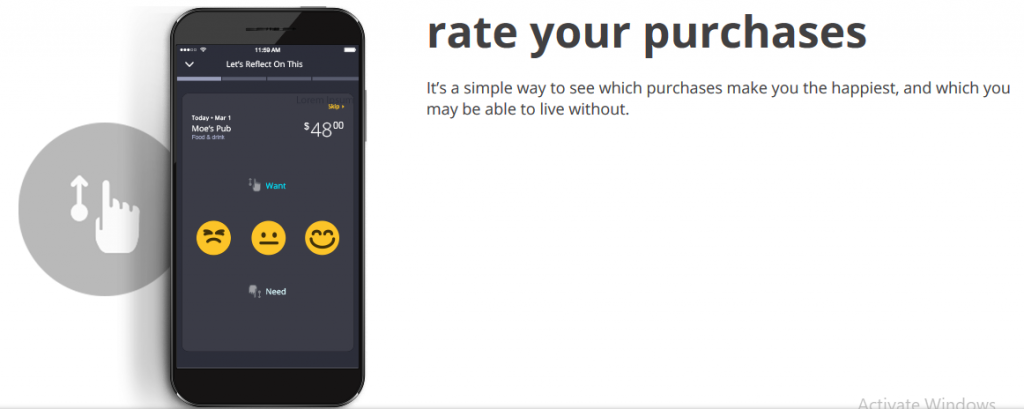

A great example of millennial-targeted content comes from JPMorgan Chase who created a new banking app last year called Finn. Not only can it help with managing your account on a daily basis but there are also automatic savings tools and charts to help you see where you’re spending money. Emojis can even be used to rate transactions which help online business banking more interactive and fun. All processes are super quick and simple to help keep millennials interested.

This is what the app looks like on your phone

And this is an example of clearly presented data using a simple and smart design

Here is also an example of how the app is promoted via the Chase website. Note how the content is short, sharp and to-the-point.

Top marketing takeaway: Considering 2/3 millennials want digital budgeting tools from their provider, it pays to be creative both from a technology perspective and a content perspective. Keep it simple, keep it practical, solve everyday problems and you’re onto a real winner.

#2 Become a Go-To Source of Knowledge

We’ve established that competition is tough in the financial marketing space, so how can you set yourself apart from other top players? Becoming a go-to source of knowledge is important. Millennials are so over pushy ads and ‘me, me, me’ content. Instead they want information that educates, informs and provides them with what they need – fast.

For example. Only 28% of millennials have a solid understanding of how to invest their money. Knowing this gives you a chance to write blogs, produce infographics and share helpful tips that will catch the attention of your target market. Step-by-step guides are ideal but be sure to always link back to your products and services making sure they too are as intuitive as possible.

Top marketing tip: Create an educational hub for your brand. Divide articles into sub categories to make them easily searchable and update this portal regularly. Once you’ve established the hub you can start to promote it using an omnichannel strategy to draw users to your site.

#3 Have a Strong Social Media Presence

If you think financial services is all about well-ironed suits and straight-faced asset managers, you’re not going to appeal to millennials. This is a generation that understands banking can be fun, innovative creative, so get on social media and start engaging your audience.

Why is this important? Well, a whopping 85% of millennials use social media and 46% have more than 200 Facebook friends. That’s a huge marketing opportunity, to think about.

- Developing your channels

First things first. Are your channels up-to-scratch? Are you posting new and enticing content that the millennial generation will want to follow? Remember, they can follow whoever they like and silence brands that disinterest them. So it’s essential to be on top form if you want to carve a great social media reputation. Several brands even have their podcast channels and you could also consider them for your business. Streaming podcasts isn’t a big deal when you can avail of podcasting solutions from https://www.agora.io/en/solutions/live-audio-streaming/ or similar software providers. Below are a few finance brands that are nailing social interaction.

Halifax and their Wizard of Oz Homebuying Ad

Halifax recently promoted their home buying and mortgage services by creating a Wizard of Oz-themed video that’s sure to put a smile on your face, this was probably aided by a professional mortgage marketing team to help them to achieve the best campaign. With the Disney movie Return to Oz released in 1985 and a host of adaptions made since, millennials have grown up with Dorothy and Co making this a highly relatable ad for millennials looking to get on the property ladder. The content was shared across multiple social sites including Facebook, Twitter and YouTube.

Top marketing tip 1: Video content will account for 80% of all internet traffic by 2020 making it a vital marketing tool and one your brand should take seriously.

Top marketing tip 2: Ensure all content you produce is relevant to your target audience. Tug on the heartstrings and emotions of millennials through nostalgia.

Robinhood Boosts Credibility and Authenticity

Robinhood is a top-pick amongst millennials looking to invest for multiple reasons. Firstly, they’ve a simple no-fuss app which gets the job done quickly. This appeals to the millennial attention span which has shrunk from 12 seconds to 8 in recent years largely due to the number of online distractions faced on a daily basis. What Robinhood does really well on social media platforms like Twitter, however, is to create authenticity. Millennials don’t want to see five-star generic reviews as these are hard to trust. Instead, they want to see organic reviews and content from big names or consumers.

Robinhood therefore rightly promoted their inclusion on the Forbes’ #Fintech 50 list to their 129K Twitter followers.

Top marketing tip 1: Boost your credibility by sharing achievements. Reshare content about your brand generated by others as this is both organic and looks more genuine than a company review which could easily be fake.

Note: Millennials are highly sceptical about fake news and are prepared to do their research. Therefore, never make up false quotes or statements and always triple check sources before sharing any information. Tweeting something considered ‘fake news’ could have a serious knock-on effect on your business taking away the credibility you worked so hard to achieve.

#4 Show Corporate Responsibility

37% of millennials say they are willing to purchase a product or service to support a cause they believe in, even if it means paying a bit more. So, what should you take away from this? Firstly, embracing corporate responsibility is important to this age group. They want to see you’re thinking more about the larger community than just your brand. By sharing your corporate efforts to better society or the planet, you can create an affinity with millennials that may otherwise not have been possible.

Interestingly, BlackRock CEO Larry Fink also sent a letter last year to CEOs of the world’s largest public companies to start accounting for the societal impact of their companies. The open letter essentially said that if companies wanted to keep receiving support from BlackRock, social responsibility had to become a priority on their to-do list.

A great example of this in action comes from financial services provider Citi who has established the Citi Foundation in order to engage communities through philanthropy, financial and career education and urban development.

Top marketing tip: Be genuine and choose a project that’s close to your heart. All corporate responsibility tasks you undertake must reflect the ethics and values of your brand.

My agency www.contentworks,agency specialises in financial services marketing. Contact me to discuss content and social media marketing.