From looking on this website to find out how you can use text messages to your advantage to create a highly engaging social media campaign, there are lots of ways you can market your fintech solution. And the fintech space is getting more and more attention from the media, the government and end-users.

It’s never been more important to have a solid Fintech marketing strategy in order to build a brand that people really love. One they can trust, that stands out from others and positions the brand as an industry leader. In order to gain that trust, you need to take a few measures of which, solid IT support could be a major one. In addition, to be on the cost-effective grounds, businesses can think of outsourcing this kind of support service. Businesses can look for IT support in Colorado or in their vicinity who can handle the entire responsibility of their company’s technical wing. In Fintech, you’re not just competing against other startups, you’re also competing with the big guys who have decades of experience and budget to play with. So, what fintech marketing strategies work? What do fintechs need to do differently? I’ve sat with my Contentworks Agency writers and we’ve pulled together 8 fintech marketing strategies for 2020 to get you started.

#1 Make Trust A Priority

We’re working in an industry that has historically suffered from a lack of trust. On top of that, we’re talking about managing people’s money. Trust should be a priority for every fintech. Trust means having customers that have your app on their phone homepage. Having customers that love your product and encourage their friends to try it out. Trust means customers who feel confident enough to try your new features and give you feedback.

Sounds amazing, right? So how do you increase trust in your brand?

- Provide valuable content that explains and reassures

- Engage customers in two-way communication on social media, email and in-app

- Host live video events that include different members of your team

- Keep your brand consistent across all channels (that doesn’t mean the same content!)

- Encourage user-generated content on social media

- Share trustworthy links to third party articles and PRs

- Encourage user reviews of your product or services

- Make sure your brand acts responsibly and takes responsibility for its actions

Check out Fintech Marketing Trends Banks Can’t Ignore

#2 Engage On Social Media

Social media is a great way to gain leads, revenue, customer feedback and build brand awareness. Whether your target customer is Gen Z, Millennial or Boomer, social media will be a core part of any marketing strategy.

When it comes to marketing a Fintech startup, the first step is figuring out where your target audience hangs out. From there, focus on two or three social media platforms and get them right. Have a strategy to build up your presence, whether it’s Instagram, Facebook, Twitter, LinkedIn or TikTok. Getting one social media platform done right is better than four mediocre attempts.

The other advantage of social media is that it provides a lot of data: the amount of shares, likes and website visits you get can tell a lot about your target audience’s preferences. Every social media channel is different, which is why it’s important to understand the platform well and devote the correct resources to it. Need a little help figuring out exactly which resources? Talk to our team.

A company we believe does Instagram marketing well is Zopa:

With a clear value proposition, friendly social media accounts and great images, the brand is hitting that all important millennial/ gen Z base.

#3 Have A Company Blog

Like any brand, fintech businesses need regular content, and a blog is one of the best mediums for passing the information. A blog helps educate consumers, builds trust and increases conversions. Here are the latest stats:

- Websites that also have a blog are shown to have 434% more indexed pages

- Companies who blog get 97% more links to their websites

- Blogs have been rated as number #5 for most trustworthy source for gathering online information

- 77% of internet users read blogs

- Titles with 6-13 words attract the highest and most consistent amount of traffic

- Marketers who prioritize blogging are 13 x more likely to have a positive ROI on their efforts

Of course, when potential customers search for your company name in Google, you want your website to be the first result. Ideally position 0 in snippets.

For instance, let’s say you own a life insurance company. Having a blog would not only keep your readers informed about your policies, but it would portray you as an expert in the field of insurances. With regular blogging, you can establish brand authority, ensuring that your readers always come to your site to learn more about the topic. A user who regularly reads a blog has a relationship with you and trusts you. For this reason, it’s important that the blog doesn’t only publish product updates, but also educates consumers on trends, products in the market, and financial jargon. A blog creates value – it’s an excellent way to provide a better customer experience than your competitors. You can also head to https://ilife.tech/the-secret-to-getting-qualified-life-insurance-leads/ or similar webpages for more tips on finding potential customers in the life insurance agency.

#4 Position Yourself As A Thought Leader

You want to be a legitimate player in the fintech space. The best way to build this legitimacy is by positioning yourself as a thought leader.

When you practice thought leadership, the media comes to you. The magazines, sites and events want to interview and feature you, so your product reaches a much wider audience.

The term “thought leader” has reverberated around the digital arena for the past few years and it seems that every CEO wants to be one. It’s the digital equivalent of having the latest iPhone or a brand-new Tesla. Here’s the problem. It does mean a leader with thoughts. Thoughts that are ground-breaking, thoughts that lead industries, thoughts that create trends and thoughts that shape ideas. It requires effort, community engagement and a genuine love for what you do. In short, it’s not for everyone.

To be an effective thought leader you must:

- Love your topic

- Be authentic

- Have practical experience

- Write, write, write. …

- Be sociable and friendly

- Network in person

#5 Get Into Email Marketing

Emails gives you direct contact with people who have asked to hear from you. Email allows you to work on customer retention and brand trust. It is also a fantastic way to gather more information on what your users want: Do they want infographics? More thought leadership? Or more community focused articles? Email marketing helps you determine exactly that.

With email you can see exactly who is with open, click-through and conversion rates. It makes it easier to gather feedback and improve certain features.

Fun Fact: The most opened emails are related to government, with an open rate of 28.77%. Emails sent by hobbies entities come in second, with a 27.74% open rate. With a 27.62% open rate, emails about religion came in third. The average open rate for all industries is 21.33%.

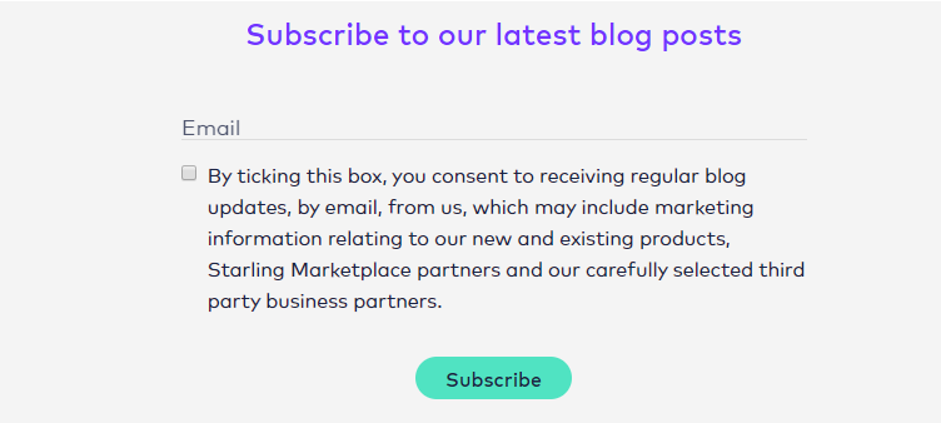

No need to send an email for every product update; a monthly newsletter can go a long way. We like Starling Bank‘s newsletter (cleverly called the Murmur). The concept is simple, a roundup of the most popular blog articles on the site.

Remember to properly opt in subscribers just like Starling:

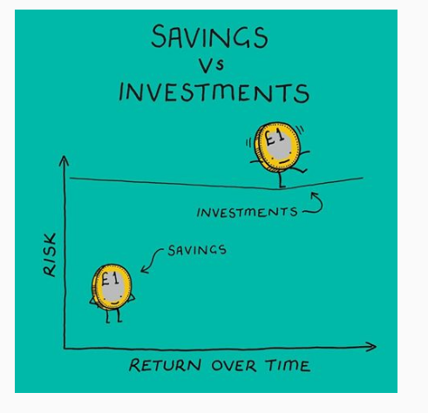

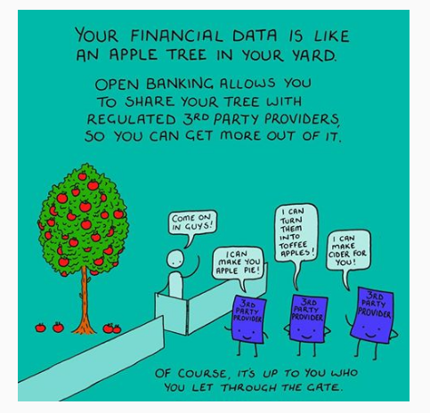

#6 Go Visual With Infographics & Videos

A user needs to pick between a one-minute video and a five-page long document. Which one do they pick? Obviously, the video. Customers are used to short and snappy messages through Instagram, Snapchat and Youtube. Fintechs here have an opportunity that incumbents didn’t: cater to the younger generation through the same preferred medium.

- 82% of consumer internet traffic will be from online videos by the end of 2020. It’s a trend that keeps on coming and you should be crafting campaigns that’ll set you apart.

- 78% of internet users watch video content online every week. 55% watch online videos every single day. And 54% want brands to produce more content. The demand is there, so why not respond to it?

- Users spend 88% more time browsing websites with video content. Marketing is also about retaining customers and this stat shows how video marketing can help. Putting a video on your landing page can also increase conversion rates by 20%.

- Viewers retain 95% of information they watch through a video. That’s significantly more than through written text.

We could go on but it’s clear video is a major player in today’s digital-centric world. The question is; how can you produce fintech video content that stands out from the crowd, showcases your brand, engages consumers and offers an interactive experience?

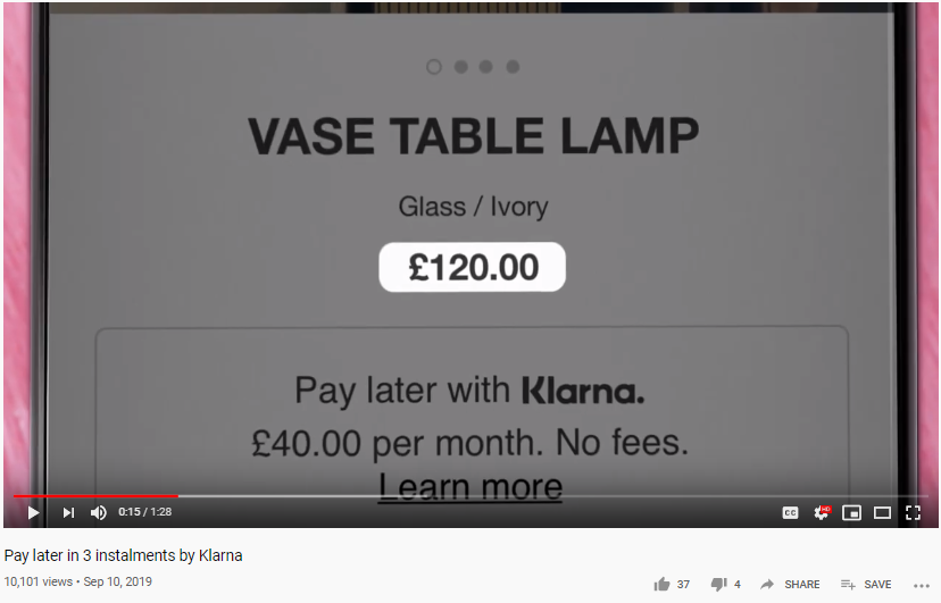

An example of a company doing this well is Klarna. The brand does short videos explaining each of their product features:

Pay later in 3 instalments by Klarna

By showcasing real life payment examples in a short (under 2 minute) video, the brand makes their product understandable, accessible and fun.

#7 Share Success Stories

If you’re like most of us, you probably feel more comfortable buying a product from Amazon after reading a couple of reviews.

Well, the same goes for Fintech. People read app reviews, personal stories and watch recommendations before downloading an app that will manage their money. That’s where success stories come in handy. ÄŸŸ‘Œ

Success stories are key to building trust: they show potential users that real humans are using and liking your product. Social proof is essential; 90% of buyers who read positive customer success content claim that it influenced their purchasing decision. This applies to Fintech too. You may not have thousands of rave reviews yet – but a couple of customer success stories published on your website is an excellent Fintech marketing strategy. Those can be case studies, interviews, or user reviews.

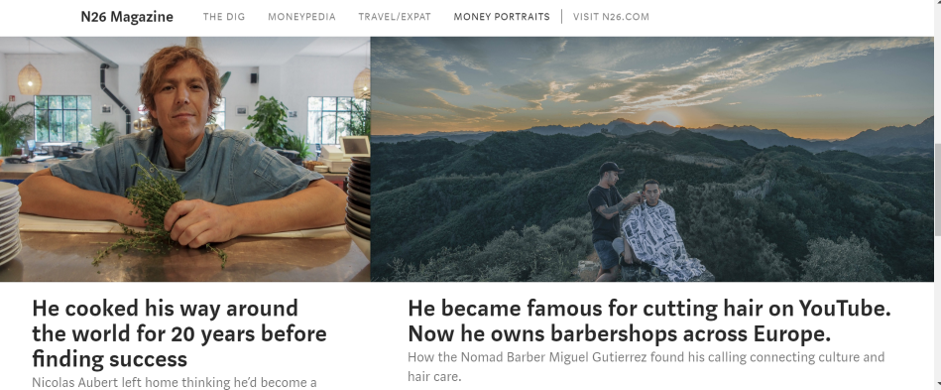

N26 does this very well on their Medium Magazine:

84% of people trust online reviews as much as personal recommendations with 31% likely to spend more on a business with excellent comments and feedback.

Contentworks provides full content marketing services for your brand. With extensive experience in the finance and tech sector, our expert team knows how to get you noticed.

#8 Have Excellent Customer Service

Awesome customer service is essential in Fintech. Why? Because old institutions are known to have terrible customer service and this is an area where Fintechs have an opportunity to thrive.

Did you know:

- 40% of customers who complain in social expect a response within one hour

- One third of all customer complaints are never answered, most of them are in social

- Answering a complaint increases customer advocacy by as much as 25%

- Not answering a complaint decreases customer advocacy by as much as 50%

Overall, good customer service increases sales, customer loyalty and enhances the brand of the company. Fintechs have a competitive edge with millennials and gen Z but it’s important to maximise it. Outsourcing social media management to a compliance savvy fintech marketing agency is one solution. Yes, we were talking about us.

These 8 Fintech marketing strategies are key to getting the competitive edge. Ready to get started with your fintech marketing? Get in contact.