Millennial Marketing – The Brands Nailing It

Smart financial brands know that their growth depends on millennials. Although millennials are set to be surpassed by Gen Z in terms of numbers, they are currently the biggest consumer group and marketers can’t afford not to woo them. Millennials are a tech-savvy and digitally-centred generation that’s after convenience and positive experiences and so their expectations from financial brands differ to those of Baby Boomers and Gen Xers. From implementing social media to attract the demographic to implementing custom product boxes to sell their product – brands must do it all to rope in this group of potential clientele.Millennial Marketing – The Brands Nailing It takes a look at how to tailor a millennial-focused marketing strategy.

Technology is a big part of daily life

Millennials stand out for their use of technology. Almost all millennials use the internet, 92% own smartphones, and 88% are on social media. Unsurprisingly, 88% of millennials are already conducting their banking online and 92% of them would choose a bank offering digital services compared to one that doesn’t.

Traditional financial services companies have been slow to adopt technology partly because of their focus on regulatory requirements and also because they have a disposition towards keeping things traditional. However, the financial industry has become more competitive especially with the rise of disruptor fintech companies who have a distinct competitive advantage when it comes to millennials and technology. Technology is no longer just part of the IT department and it has become a tool for customer acquisition and retention.

The millennial marketing approach

To acquire and retain millennial customers, marketers need to have a digital and technological orientation. Integrating technology into marketing strategies will increase marketing efficiency and help enhance customer experiences through personalization. The retargeting methods in digital marketing are popular among marketers. TV advertising is not behind, in terms of utilizing data and analytical tools. For instance, software companies such as Samba TV are approached by advertisers for TV viewership data that can boost their TV campaign reach.

Among the various emerging technologies, marketers should closely consider voice recognition, especially considering 71% of millennials use voice assistants daily. They would even like to include more of this technology in their daily activities.

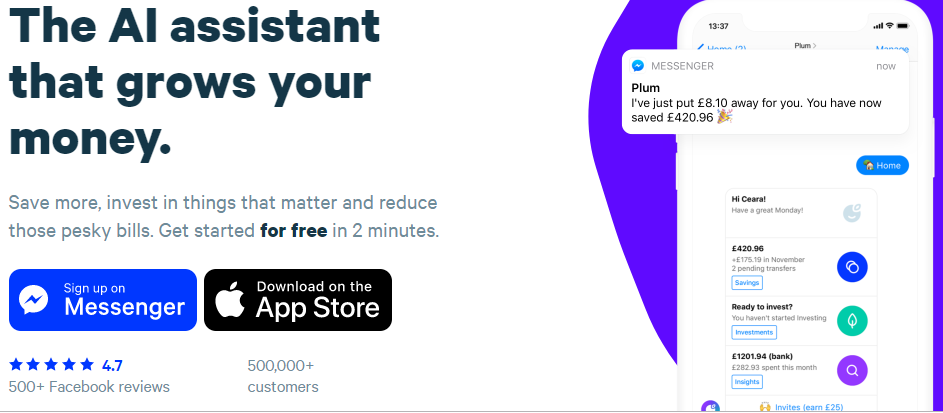

AI and chatbots are also a big hit with millennials. In fact, 70% of the millennials who have interacted with an AI chatbot are happy with the experience. The inclination that millennials have towards chatbots and AI is consistent with Plum’s focus on this generation. Plum is a chatbot that’s bridging the gap between the financial industry and people who lack financial prowess.

Plum integrates AI and chatbot intelligence and this appeals to its target audience which consists mainly of millennials. The company behind Plum is marketing effectively because it’s based on something that millennials love and marketers need to do the same.

Tech-savvy does not mean financially savvy

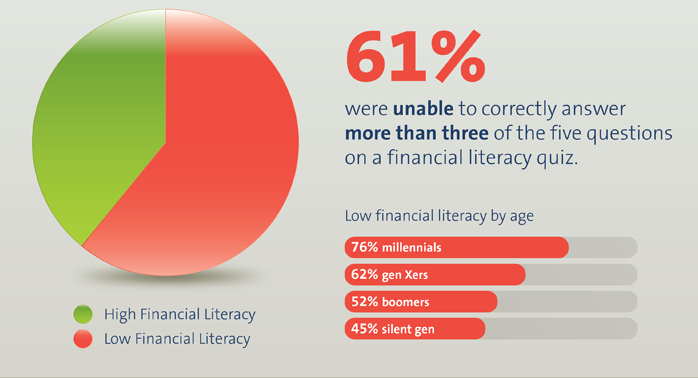

Millennials’ financial knowledge is in stark contrast to their reputation as a tech-savvy generation. Despite their extensive use and know-how of technology, millennials are the least financially literate generation among the overall population. Only 24% of millennials demonstrate basic financial literacy and a mere 8% have high financial literacy.

Source: FINRA

Marketers need to appreciate that millennials may know how to use technology but they struggle with basic finance terms and information.

#1 The millennial marketing approach

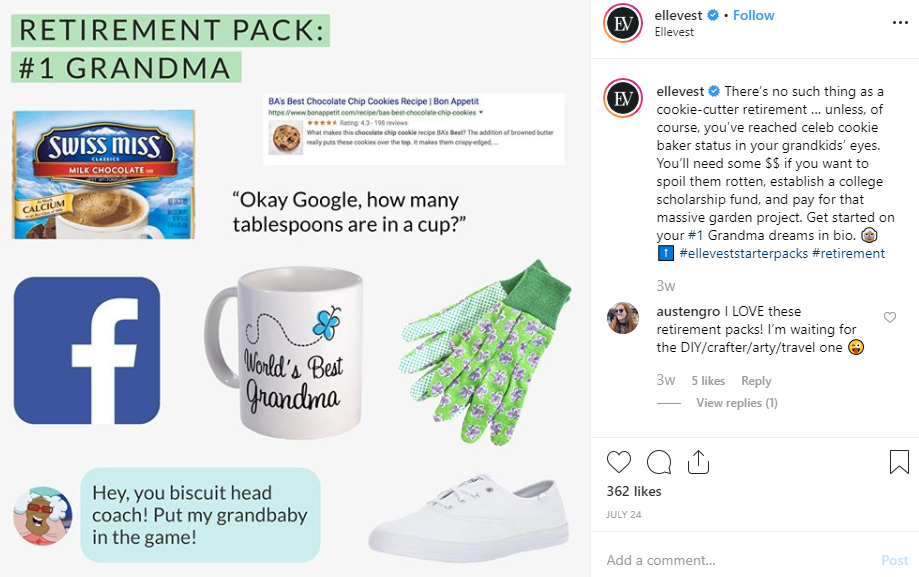

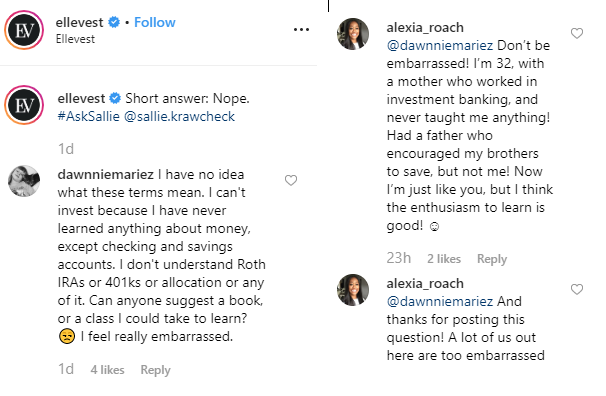

Marketers need to educate. Ellevest is a successful financial brand because of its focus on educating its target clients. There’s a large disparity between men and women when it comes to saving and women are twice as likely as men not to have any retirement savings. Ellevest is working on educating women to close this gap and this is where the brand acquires its competitive edge.

A quick look at Ellevest’s Insta feed shows why the company’s marketing strategy garners engagement. People have questions and they want answers. A focus on education is crucial to the success of any financial marketing strategy targeting millennials and marketers need to be proficient at eliminating any jargon and adding knowledge.

Millennials have a unique consumption pattern

Older generations may value things like practicality and duty but millennials are after positive experiences and they value happiness and discovery. Millennials seldom want to miss out on experiences and this may explain why the millennial generation has given rise to terms like YOLO (You Only Live Once) and FOMO (Fear Of Missing Out) – they want to maximise on unique sharable experiences.

#2 The millennial marketing approach

Millennials are impatient. They also don’t want to feel like they’re lagging behind or missing out on an opportunity. Marketers can use this to their advantage by offering strong call to actions and by placing deadlines on marketing messages. The more urgent and awesome the campaign, the more it will interest millennials. In addition, marketers need to ensure that the brands are brought to life through promotional campaigns that can leave a lasting impression. This can be accomplished by promoting the brand’s best products. An impressive promotional event that showcases the products in the best light can bring out the company swag that might impress the millennials.

When it comes to millennials it’s also vital to invest in social media marketing. Consumers spend about 142 minutes on social media daily and almost 50% of millennials are likely to spend on products and experiences they discover on social media. Facebook and Instagram are especially important when it comes to social media marketing because they have the collective potential to maximise both reach and engagement. Twitter is also ideal for short, sharp update and for creating excitement about a product or service.

Millennials are different yet the same

Millennials can be split into two distinct groups – the older and younger millennials. Older millennials are those who are currently aged 30-38. This is the group of millennials who took the brunt of the 2008 financial crisis and have a harder time accumulating wealth as a result. Older millennials lived part of their defining years when the cost of living was very high. Student loans were hard to pay off, the job market was tough, and wages were stagnant. This resulted in most of them deferring common milestones like marriage, buying homes, and saving for retirement until the recession passed.

At the other end are the younger millennials who are in the 23-29 age range. This group of millennials lived through the recovery period after the recession. As a result, a significant portion of this group is risk-averse even though they are entering a better job market compared to the older generation. Nonetheless, millennials in this group have more time to plan their financial futures.

It’s easy to assume that since these two millennial groups went through different experiences they need different marketing antics. However, when you look closer, it’s clear that both groups of millennials want similar things – help with saving and staying on top of their finances. When combined, both the younger and older millennials are interested in cutting debt, gaining positive experiences in the present, and saving up for the future.

#3 The millennial marketing approach

Money Supermarket, a business specialising in financial services, is geared towards millennials. The company’s price comparison service covers a range of products that most millennials are interested in including travel, car and home insurance, credit cards and loans and mortgages. By providing a service that not only allows saving but making sound financial decisions and realising financial goals as well, the company engages both the older and younger millennials.

Money Supermarket offers solutions for millennials whether one is looking to save…

…or to stay on top of their financial game.

Marketers need to be creative with their marketing so that their campaigns encompass the needs of both millennial groups.

There’s a love-hate relationship between millennials and banks

Millennials have long been touted as having little interest in personal banking but as they mature, their financial needs are becoming more pressing. Increased awareness of this shift in financial needs may explain why financial proactivity is growing among millennials as 87% of them are spending more time managing their finances. However, the same millennials are still sceptic of banks.

Loyalty among millennials is fickle. 53% of them cannot differentiate between the service offered by their bank and other banks and only 17% say they can’t imagine switching banks. This is unsurprising because most millennials still remember the 2008 financial crisis and how it impacted their lives. Also, millennials have a history of being ignored by traditional bank marketing methods. Bank marketers have ranked “attracting a younger audience” as ninth in an ‘importance’ survey as recently as 2018.

#4 The millennial marketing approach

When dealing with millennials, marketers need to focus on addressing needs because even though the generation requires financial services, they are difficult to retain. By focusing less on the products and services on offer and more on consumer pain points, financial marketers increase the likelihood of millennials warming up to them.

Santander Bank is leveraging tapping into millennials’ needs and this is promoting meaningful engagement with its largely millennial audience. In response to the millennial generation’s need for convenience and the increased use of mobile banking which currently stands at 50%, Santander has a handy mobile banking app. Furthermore, millennials are interested in brands that exhibit social responsibility and Santander resonates with this through its social responsibility campaigns which align with millennial values and build brand loyalty.

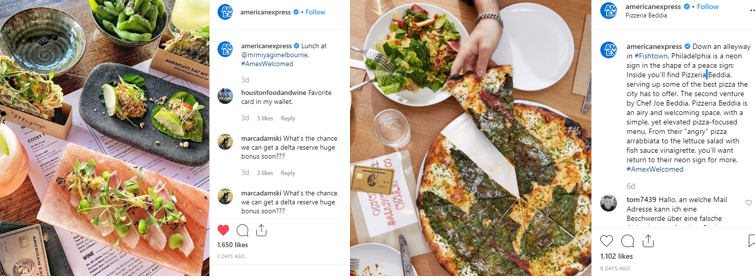

Even Amex, one of the traditional banks, has realised the importance of tapping into the wants and needs of millennials. Millennials love to travel and they look for destinations that provide “memorable and original moments” and “activities that focus on sustainable and personalized local experiences.” Although Amex is a finance brand, it’s tapping into the passions that millennials have. The brand is garnering engagement by showing original and personalised Amex experiences in different locations. This content is relevant and on trend.

My team specialises in marketing for millennials. Improve your engagement with millennials today with the help of a customised content marketing strategy from Contentworks Agency.